Quadrennial Monitoring of the Packaging Supply Chain: Updated Status as of May 2024. General Economic Overview and Analysis of the Manufacturing Sector and Its Impact on the Packaging Industry.

Barbara Iascone

Istituto Italiano Imballaggio

Manufacturing Industry Data

This report summarises the performance of the manufacturing sectors with the highest consumption of packaging materials, divided into the major areas of food and non-food. The data on the evolution of the manufacturing sectors are drawn from sectoral analyses conducted by trade associations, ISTAT, the Italian Packaging Institute's database, and Prometeia. When analysing the segmentation of the manufacturing sector, focusing on industries most closely related to packaging, the following trends emerge for 2024:

- The food and beverage sector is anticipated to reverse the trend seen in 2023, with growth projected around +1%.

- According to the analyses conducted by the Cosmetica Italia research centre, the cosmetics sector is expected to grow by 9.8%, surpassing pre-COVID crisis levels.

- The pharmaceutical sector is likely to maintain the positive trend observed in 2023, closing 2024 with a +2%.

- The fast-moving consumer goods (FMCG) sector is anticipated to grow by approximately +1.8%, followed by the fashion industry with +0.8% and the furniture sector, which is projected to experience near stability (+0.2%). The only sector predicted to decline is construction, with an expected contraction of around -1.8%.

|

2020 |

2021 |

Var. % 21/20 |

2022 |

Var. % 22/21 |

Preliminary 2023 |

Var. % 23/22 |

|

|

Turnover (estimated, € millions) |

33,256 |

35,216 |

+5.90% |

40,652 |

+15.40% |

40,710 |

-1.20% |

|

Employees (estimated) |

- |

- |

- |

109,491 |

- |

- |

- |

|

Companies (estimated) |

- |

- |

- |

7,257 |

- |

- |

- |

|

Production (estimated, 000 tons) |

17,002 |

18,194 |

+7.00% |

18,089 |

-0.60% |

17,500 |

-3.30% |

|

Export (estimated, 000 tons) |

2,846 |

3,029 |

+6.40% |

2,961 |

-2.20% |

2,627 |

-11.30% |

|

Import (estimated, 000 tons) |

2,091 |

2,419 |

+15.70% |

2,694 |

+11.40% |

2,651 |

-1.60% |

|

Apparent Consumption (estimated, 000 tons) |

16,247 |

17,583 |

+8.20% |

17,822 |

+1.40% |

17,524 |

-1.70% |

The Packaging Sector: A Preliminary Assessment

As of the drafting of this report, data for 2023 are still under analysis; therefore, we can only provide preliminary results. Production is expected to decrease by 3.5%, perfectly aligning with the overall manufacturing trend (-2.3% in 2023). Turnover is also expected to decline, though to a lesser extent than production, with a decrease of 1.5% compared to 2022.

A significant trend to highlight is the shift in foreign trade, with imports surpassing exports for the first time, resulting in a negative trade balance: approximately 24,000 more tons were imported than exported. Both imports and exports are experiencing a negative trend, but the former to a much lesser extent, with a decline of -1.6% compared to -11.3% for exports.

Packaging Usage in 2023

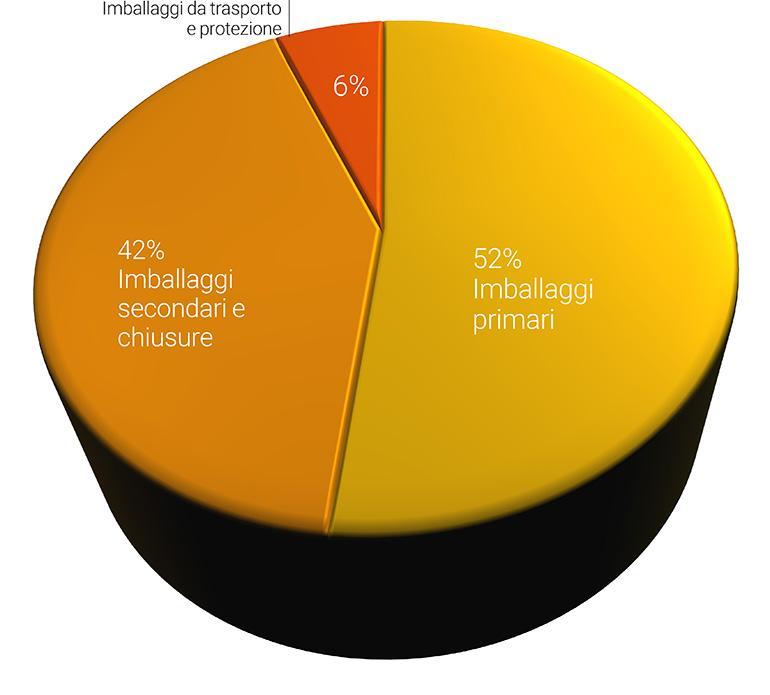

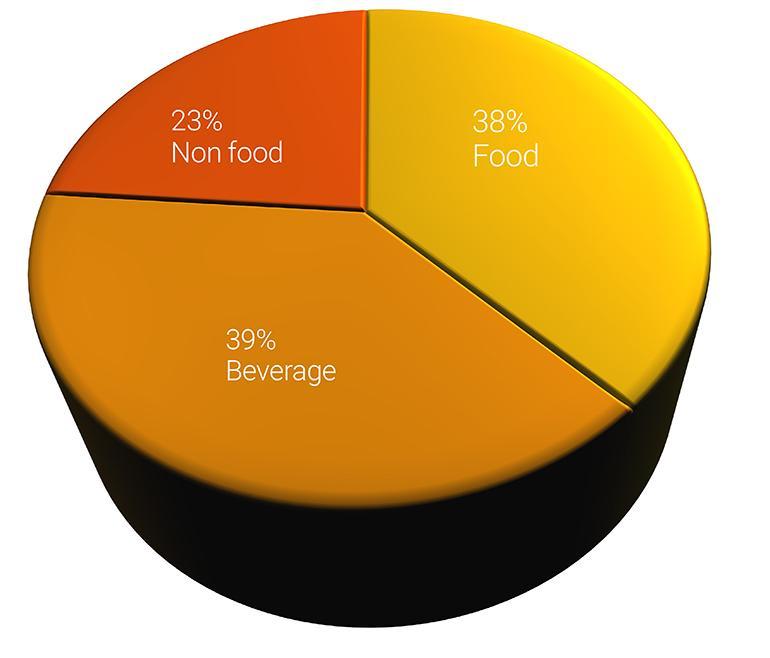

In 2023, approximately 12.7 million tons of packaging were used (i.e., filled) in Italy. Of this, 52% pertains to primary packaging and 42% to transport and protective packaging; the remaining 6% represents secondary packaging and closures. 77% of the total is intended for the food and beverage sector, with 23% for non-food. When analysing the tonnes of packaging used, around 36.9% are made up of glass packaging (though this figure is somewhat overestimated due to the heavier nature of glass). Paper and cardboard account for 26.2%, followed by plastic packaging (including flexible multi-layered materials) at 18.3%. In these latter cases, market share is somewhat underestimated due to the lightweight nature of these materials, which are widely used in packaging a broad range of products.

Finally, wooden packaging, mostly linked to transport, constitutes 13.7%, followed by steel packaging at 4.3% and aluminium packaging at 0.5%.